workers comp taxes texas

Clearly HOA workers comp insurance is an essential form of protection that every homeowners association should have in their arsenal. Its a little bit like whiplash compensation consultant Ashish Raina said of the downturn.

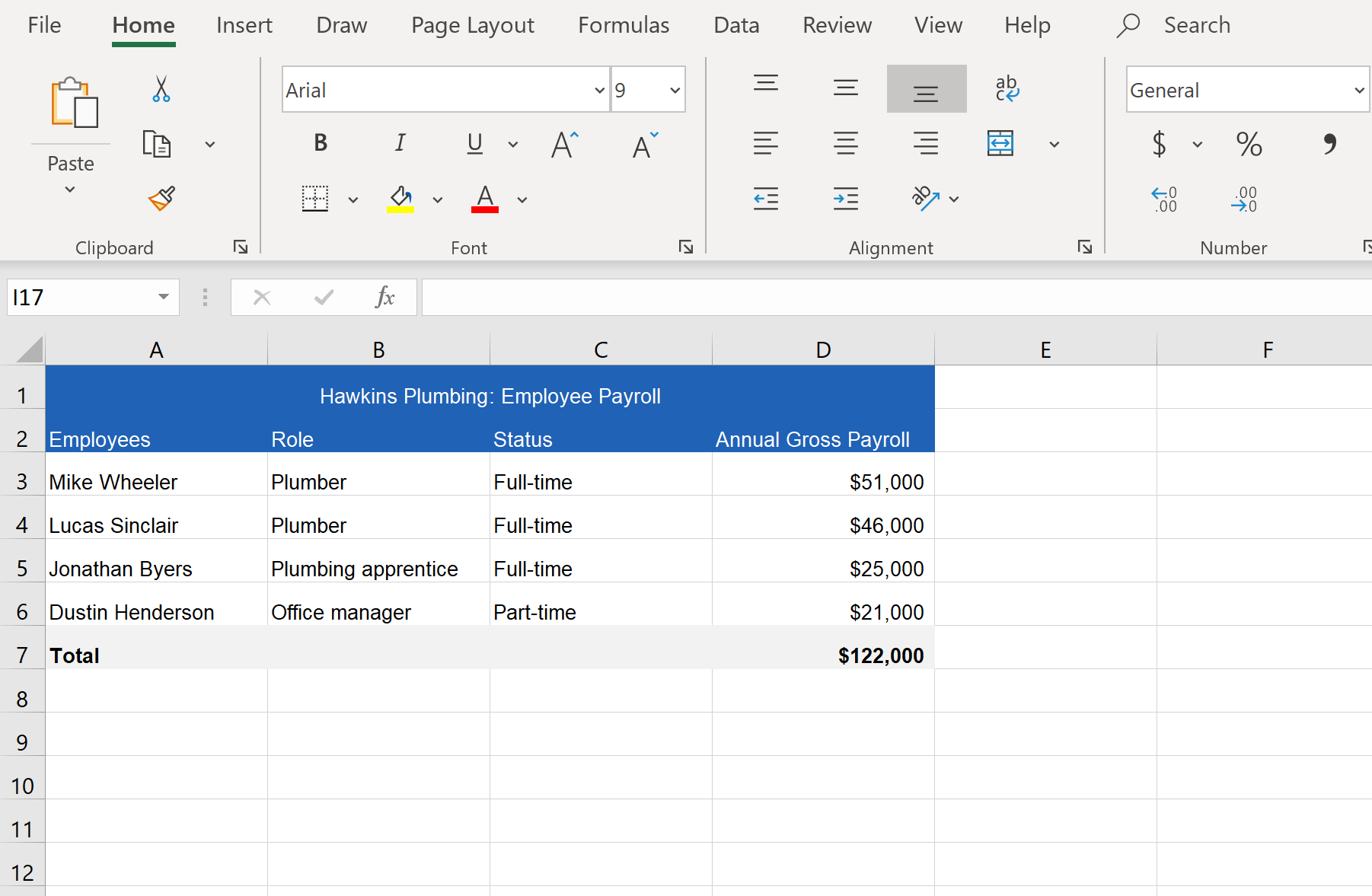

A Complete Guide To Texas Payroll Taxes

Illinois Workers Comp Verification.

. 2 spots this year continuing their long-running lock on the top of the rankings. New York New Jersey and Massachusetts but would be nonstarters in other big right-to-work states such as Florida and Texas. There is only one state payroll taxunemployment insurance and it is paid by the employer.

HOA boards who need professional assistance can. COLLECTION OF TAX AFTER WITHDRAWAL FROM BUSINESS. The rate in Texas is currently 625 at the state level although cities counties districts and other local taxing jurisdictions can impose their own additional rate of 2 for a combined total sales use tax rate of 825.

Be an employee 2. However coverage may be provided by a business they sub-contract with. They often need to get workers comp too.

Yep theres not even state income tax in the Lone Star State As an employer youll pay Texas Unemployment Insurance You can obtain your tax rate by visiting the Texas. On June 3 2022 at 919 AM. Officers who are not excluded from coverage must utilize a minimum payroll of 59800 and a maximum payroll of 234000 in order to calculate the cost of workers comp insurance.

TEXAS WORKERS COMPENSATION ACT. Based on polling of nearly 700 CEOs and business owners from every US. Anyone can search by.

If youre shopping for workers comp you may be wondering who the biggest workers comp insurers are. Without it HOAs can face costly liabilities which can cripple their financial health. Tech talent is still in high demand but compensation packages could start to look different as companies recruit.

You have the right to say no The laws in each state provide that you can pursue a workers compensation claim without fear of reprisal or. Call 888-611-7467 for a Workers Compensation Specialist. The market is turning.

Understanding what types of insurance an HOA needs is not always easy. Contact Info For Your Texas Life And Health Licensing Exam To help with your examination scheduling we have provided below information on Texas licensing requirements its insurance department and examination scheduling facilities. Employer has insurance 3.

State conducted in January and. 5 requirements for workers comp eligibility. The state of Illinois provides a free online tool for verifying workers compensation insurance coverage.

If youve filed a workers compensation claim you may be asked to attend an examination with a doctor other than your treating physicianThese exams which are called independent medical examinations IMEs in most states can have a significant impact on the outcome of your case. And if your boss offers you some incentive in an attempt to persuade you against filing a workers compensation claim this is illegal. 1099 Independent Contractor Questions.

Texas Workers Compensation Act 86th Texas Legislature R 2019 in HTML Format Texas Legislative Council website SUBTITLE A. Tech stocks are slumping which is bad news for employees and even industry powerhouses are slowing hiring and laying people off. Texas Mutual Insurance Co.

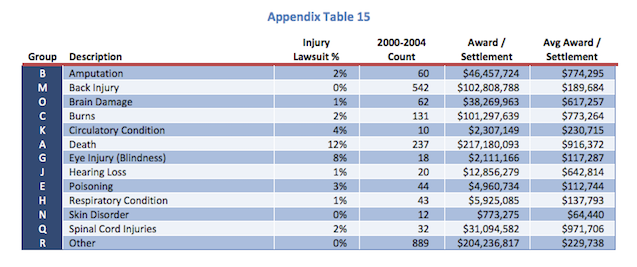

Box 149104 Austin TX 78714. The state of Texas may be big but its list of payroll taxes is small. Moreover similar injuries can yield vastly sometimes cruelly different results even when they occur in neighboring.

Texas Department of Insurance - Agents Licensing Division Address. No small business owner can start running their own payroll taxes without knowing their states rates for sales and use taxes. Best Tax Software.

In whats become an annual rite of spring for its Best Worst States for Business survey of CEOs Texas and Florida held on to their No.

The Complete Guide To Texas Payroll Taxes 2022

Workers Compensation Payroll Calculation How To Get It Right

Workers Compensation In Texas A Brief History International Development 18 Th Century Pirates 1 If You Survived The Injury No Death Benefits Loss Ppt Download

Is Workers Comp Taxable Workers Comp Taxes

Is Workers Comp Taxable Hourly Inc

Texas Workers Compensation Insurance Laws Forbes Advisor

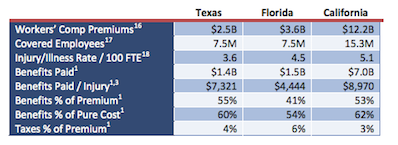

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

The True Cost To Hire An Employee In Texas Infographic

Is Workers Comp Taxable Hourly Inc

What Is The Bonus Tax Rate For 2022 Hourly Inc

Texas Non Subscriber How Can Injured Worker S Get Compensation

A Complete Guide To Texas Payroll Taxes

Are The Benefits From Workers Compensation Taxable In Texas D Miller

Texas Workers Compensation Laws Costs Providers

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

A Quick Guide To Workers Compensation In Texas Employers

Comparison Of State Workers Compensation Systems Texas Department Of Insurance Workers Compensation Research Group Pdf Free Download